Homeowners On The Fence About A Short Sale Should Consider The Year End Expiration Of Tax Break

It seemed like just yesterday that underwater homeowners faced a conundrum to either short sale or wait things out to see if the market would improve. For many homeowners the market improved so much that they now sit right side up with actual equity in their home. Short sales have become equity (or what many people refer to as “normal”) sales.

Even with the hot sellers market, some Bay Area homeowners remain underwater. Because we passed the halfway point in 2013, homeowners have that same decision as before. With the Mortgage Debt Forgiveness Relief Act set to expire at the end of this year, homeowners on the fence must choose whether to short sale and take advantage of the tax break or try another option.

What would those other options be?

1- Although banks have been downplaying the loan modification option for some time, homeowners can still apply for either a HAMP (government guidelines) or one of the in-house lender modification programs. Usually the banks mirror the HAMP guidelines but some differences often exist. Either way, those choosing this option should consider using a non-profit counselor to advocate on your behalf, instead of dealing directly with the bank.

2- Refinance through HARP (Home Affordable Refinance Program). Homeowners with no late payments in the past 12 months who are underwater may be eligible to refinance through the HARP loan. Many guidelines exist including that the loan be owned by Fannie Mae or Freddie Mac. Those interested might consider working with a knowledgeable loan officer who doesn’t necessarily need to work with your current servicer.

3- If the above options don’t work, then a short sale may be the best bet. A short sale, handled correctly, will allow the seller to exit the home without any debts. The short sale can be particularly handy for homeowners with multiple liens and/or HOA liens. Depending on the status of your loans, a foreclosure may leave homeowners open to financial liabilities, while a short sale many times allows a cleaner break.

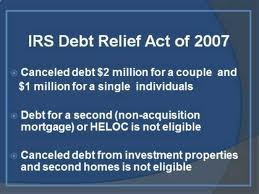

The Importance Of the Mortgage Debt Forgiveness Relief Act

In a short sale, the Mortgage Debt Forgiveness Relief Act plays an important part of the loan forgiveness. The bank essentially “pays” the delinquent borrower the amount of debt forgiven, which is why creditors send Form 1099-C to the borrow showing the amount of “income” that he or she received as forgiven debt.

We conferred with CPA Robert Caplan about the Mortgage Debt Forgiveness Relief Act.

Mr. Caplan mentioned, “Homeowners should keep in mind that they can only apply this provision if it was to purchase or improve the property. The advantage is particularly important if they have not re-financed the hell out the house.”

If considering a short sale, a homeowner might worry about being a target for an audit but Mr. Caplan mentioned, “It appears that there is not a lot of auditing for relief indebtedness if you do your tax planning carefully.

To many people, it would seem logical to once again extend the Act but with the Congress scoring a 14 percent approval rating who knows if they will use logic to extend this program.

This sellers market will not last forever. Interest rates should climb. At some point, real estate inventory will probably rise. Those on the fence should consult with their financial planner, accountant or other professional who can look at the big picture to decide if now if the time to hold on or sell and take advantage of the Mortgage Debt Forgiveness Relief Act.